PRINT

IT

RESELLER.UK

17

NOTEBOOKS

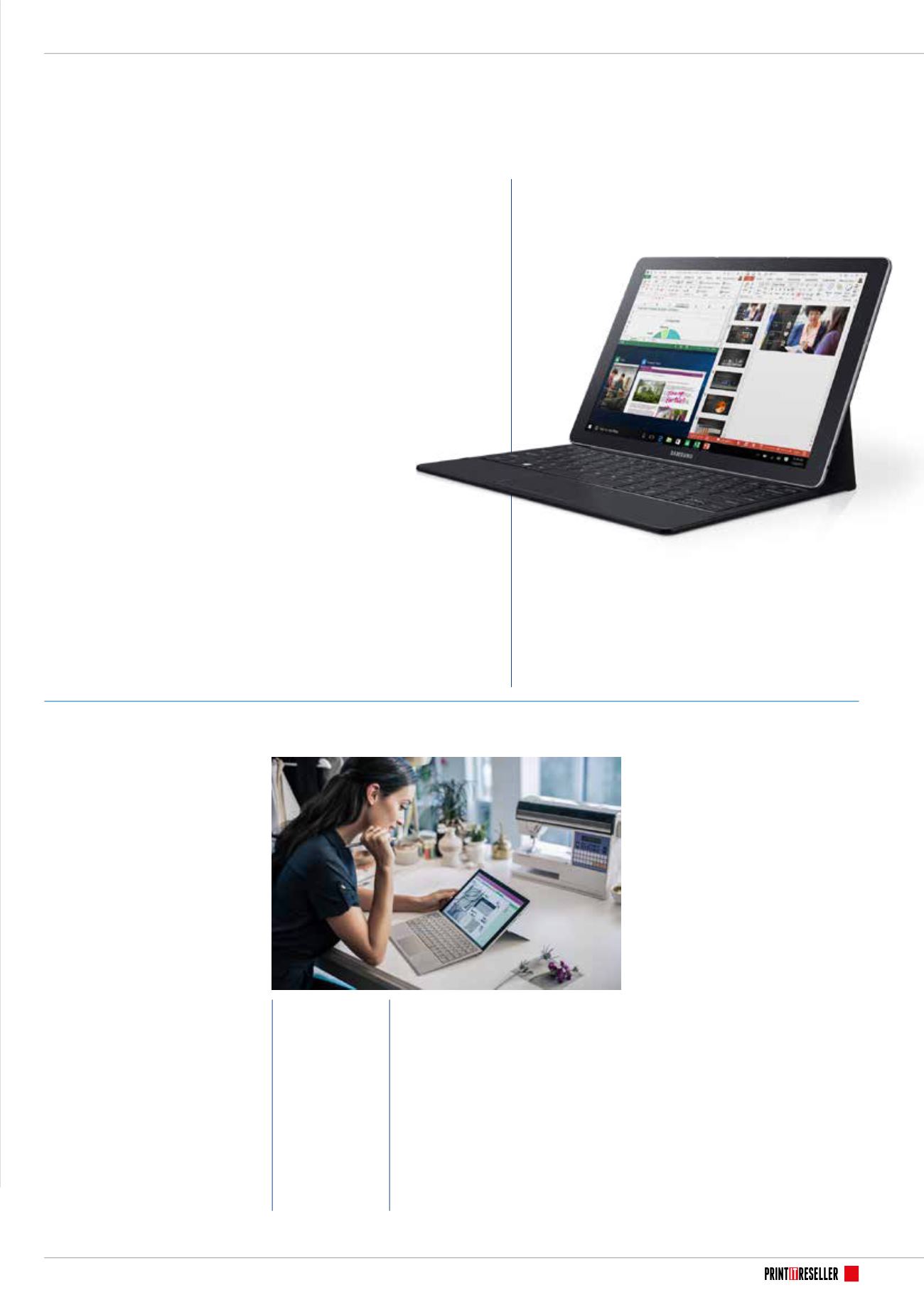

The Samsung Galaxy TabPro S, now available through Samsung’s

Accredited IT Resellers, is the company’s latest 2-in-1 premium

tablet powered by Microsoft Windows 10 Pro. It integrates the

most popular features of laptops and tablets with the security and

familiarity of the Windows 10 platform for businesses. Weighing

just 693 grammes, the Galaxy TabPro S comes with a fully equipped

keyboard cover, enabling it to be used as a desktop or tablet.

While the overall Tablet market

contracted in 2015, 2-in-1 Detachable

Tablets have become a bright spot.

According to a new Strategy Analytics'

Tablet & Touchscreen Strategies

report

1

, the segment is forecast to

grow 91% over the next five years due

to lower prices and better designs.

The research organisation also points

out that detachable tablets give traditional

PC vendors like Asus, Acer and HP a niche

in which they can credibly compete against

mobile device heavyweights.

Eric Smith, Senior Analyst, Tablet &

Touchscreen Strategies, added: “Vendors

have refined 2-in-1 Tablet products in the

last year to be affordable and functional and

there is plenty of headroom for the segment

to grow in the next five years as White Box

vendors seek to differentiate their low-cost

products. The growth rate among 2-in-1

Tablets will far outpace those of traditional

Slate Tablets, though from a smaller base, as

they compete for the spot of the secondary

computing device in the home.”

Key points from the report include:

n

By 2019, 2-in-1 Tablet growth will show

a five-year compound average growth rate

(CAGR) of 57%, compared to a 2% five-

year CAGR for Slate Tablets;

Futuresource Consulting also

highlights the big steps being

taken by Microsoft, particularly in

education. Its latest #EdTech K-12

Market Report argues that Microsoft

is poised this year to raise its game

in the fight for adoption and market

share in the worldwide K-12 PC/

Tablet market in 2016.

It points out that in the past few years

Google has gained rapid traction in the US

market with Chrome OS (via Chromebooks)

at the expense of both Microsoft and

Apple. Q3 2015 saw Chromebooks reach

over 50% of sales for the first time (51%

of US Qtr 3 2015 K-12 sales) with 1.63

million units sold.

The rise of Chromebooks has coincided

with the need for Districts to implement

online assessment (and the stipulation

that all devices needed keyboards). The

combination of a simple-to-use ecosystem,

attractive hardware price point and

industry leading management platform

has resulted in Chromebooks gaining

widespread momentum in the US market.

Outside the US market, however,

n

After a decline in 2015, the overall

Tablet market is due to return to modest

growth in 2016, due to more innovative

designs and enabling technology in 2-in-1

and Slate Tablets alike;

n

Microsoft has legitimised the Windows-

based Tablet with the Surface Pro 3 and

the lower-cost Surface 3. In combination

with the boom in 2-in-1 Tablet sales, the

Windows Tablet market share will reach

10% in 2015.

Peter King, Service Director, Tablet &

Touchscreen Strategies, said: “The timing

could not be better for 2-in-1 Tablets

as Windows 10 makes the multi-mode

computing experience

smoother; Intel's Skylake

processors hit the

market at the end of 2015; and

Windows Tablets have become more cost-

competitive with Android Tablets. Windows

provides a familiar environment for

traditional PC vendors to compete in the

Tablet market and also gives CIOs a higher

level of comfort when considering higher-

end Tablets in the commercial setting.”

1. Q3 2015: Tablet Customer Type, Channel Type &

Form Factor Shipment Forecast by Region 2010 – 2019

(

)

where there is no short-term driving factor

such as a switch to online assessments,

Chrome is growing at a much slower

rate (3% share of Rest of World in Qtr

3 2015). Many countries, especially the

major emerging markets such as Brazil,

Mexico and India, do not have the

connectivity required to run a cloud-based

infrastructure and although Chrome

adoption is developing steadily in the more

mature Western European markets, it’s

not at the same explosive growth rate as

witnessed in the US.

Futuresource

says that 2

in 1 products

have long

been viewed

as ideal for

the education

sector

The growth rate among

2-in-1 Tablets will far

outpace those

of traditional

Slate Tablets

Strategy Analytics:

2-in1 detachable tablets a bright spot

Futuresource Consulting: Microsoft raises its game in education

Moreover, outside the US, Microsoft has

started to fight back, winning significant

projects in emerging K-12 markets, such

as a 960,000 unit deal in Mexico and

an 11,000 unit deal with the Microsoft

Surface in the UAE as part of the Bin

Rashid Smart Learning program.

Its push is being led by the launch of

Windows 10; by the introduction of sub-

$300 notebook devices like the HP Stream

and Acer Cloud Book, which challenge the

Chromebook price advantage; and by the

introduction of 2 in 1 products (devices

that can either operate as a tablet or

notebook via detachable keyboards, or 360

degree convertible devices).

Futuresource says that 2 in 1 products

have long been viewed as ideal for the

education sector, but the high price points

(devices typically over $500) have led to

relatively limited adoption to date – 5%

of US demand in Qtr 3, 3.7% globally. As

prices on these devices drop to as low as

$300-350 retail, Futuresource expects 2 in

1 products to gain 11% market share in

the US in 2016 and 8.5% globally.

Source:

...Notebooks continued

Photo courtesy

of Microsoft