01732 759725

36

MAILING

Three quarters

of direct

mail users

questioned

said that

direct mail

delivers a

good return

on investment

The British office worker’s love/hate

relationship with paper is laid bare

in a recent survey by Danwood. Nine

out of 10 workers questioned by the

document solutions provider said

there would always be a reason to

print documents and 80% said they

needed paper to do their jobs. Yet,

almost as many (73%) said they were

trying to reduce their reliance on the

printed page.

Digitisation should help them do this

in relation to internal document workflows

and the sharing of information. But what

of other uses of paper, such as direct

marketing? Switching to e-marketing might

help a business reduce its carbon footprint

and be good PR, but does it make sense

from a commercial perspective?

A new study by Royal Mail MarketReach

suggests not. Three quarters of direct mail

users questioned said that direct mail

delivers a good return on investment. The

same proportion believes that consumers

are more likely to retain a printed mailshot

than an email.

Even so, digital channels remain more

popular than direct mail. According to

Royal Mail MarketReach’s new report,

Smart Marketing for Small Businesses

, the

most popular channels for SME marketing

are email (82%), social media (62%),

online advertising (50%) and direct mail

(46%). Only 16% of SMEs currently use

search marketing, with just 7% using

telemarketing.

To help SMEs explore the possibilities

of direct mail, Royal Mail has launched

MailshotMaker, an online tool that can be

used to design mailshots for distribution to

mailing lists created from Royal Mail data

or the user’s own customer lists. Prices,

including printing and postage, start at 49p

plus VAT per mailshot.

Enduring appeal

A separate Royal Mail MarketReach

report,

The Life Stages of Mail

, underlines

the enduring appeal and effectiveness of

hard copy marketing for all age group. Its

analysis shows that the average response

rate to addressed mail (i.e. buying or

ordering) in the last 12 months is 26.7%.

The report explores how people at

all seven stages of life read, share and

respond to direct mail, including:

n

Fledglings

– young adults living with

their parents;

n

Sharers

– adults living in shared

accommodation;

n

Couples

– adults living only with their

partners;

n

Young Families

– adults living with

child(ren) below the age of secondary

school;

n

Older Families

– adults living with

at least one child at secondary school or

further education;

n

Empty Nesters

– adults with no children

at home and at least one still working; and

n

Older Retirees

– either one or two

adults living as partners and dependent on

Don’t give up

on paper yet

New research from Royal Mail highlights the enduring appeal

of direct mail, even among so called digital natives

income from pensions.

Its analysis shows no marked variation

in response rates between different age

groups. Indexing the findings and taking

the average response across all age groups

as 100, Royal Mail MarketReach found

that all groups were within 20 index points

of the average.

Missed opportunities

Perhaps surprisingly, Fledglings, who tend

to be characterised as digital natives and

are assumed to have a clear preference

for electronic communications, are 18%

more likely than the general population to

welcome direct mail and 32% more likely

to find it memorable.

Almost a quarter (23%) of Fledglings

have bought or ordered something as a

result of receiving direct mail in the last

year and 31% have kept a piece of direct

mail for future reference.

Nevertheless, Royal Mail points out that

young people receive less mail than older

groups as advertisers erroneously assume

they don't want to receive it or won't

respond to it. This suggests that businesses

are missing an opportunity to market

themselves to young people.

Choice matters

Another key finding of

The Life Stages of

Mail

report is the importance of providing

a choice of response mechanism, as results

show that people in different life stages

like to respond to mail in different ways

(see graphic).

Royal Mail suggests that the response

levels of specific age groups can be

improved by highlighting the channel

the target market prefers. For example,

Young Families are much more likely to

go online to make an enquiry or request

more information as a result of receiving

mail than other life stage groups. Older

recipients are more likely to respond by

post or phone call.

Addressed mail generates response

By life stage, all groups cluster close to the average

26.7%

BOUGHT OR ORDERED FROM DIRECT

MAIL IN THE LAST 12 MONTHS*

23.3%

21.7%

26%

29.6%

26.9%

25.8%

31.7%

FLEDGLINGS

SHARERS

COUPLES

YOUNG FAMILIES

OLDER FAMILIES

EMPTY NESTERS

OLDER RETIREES

*Source: TouchPoints 6

Clearly, however, there are differences between the groups. For direct response

marketers, perhaps the most important is in the channel they used to respond.

6

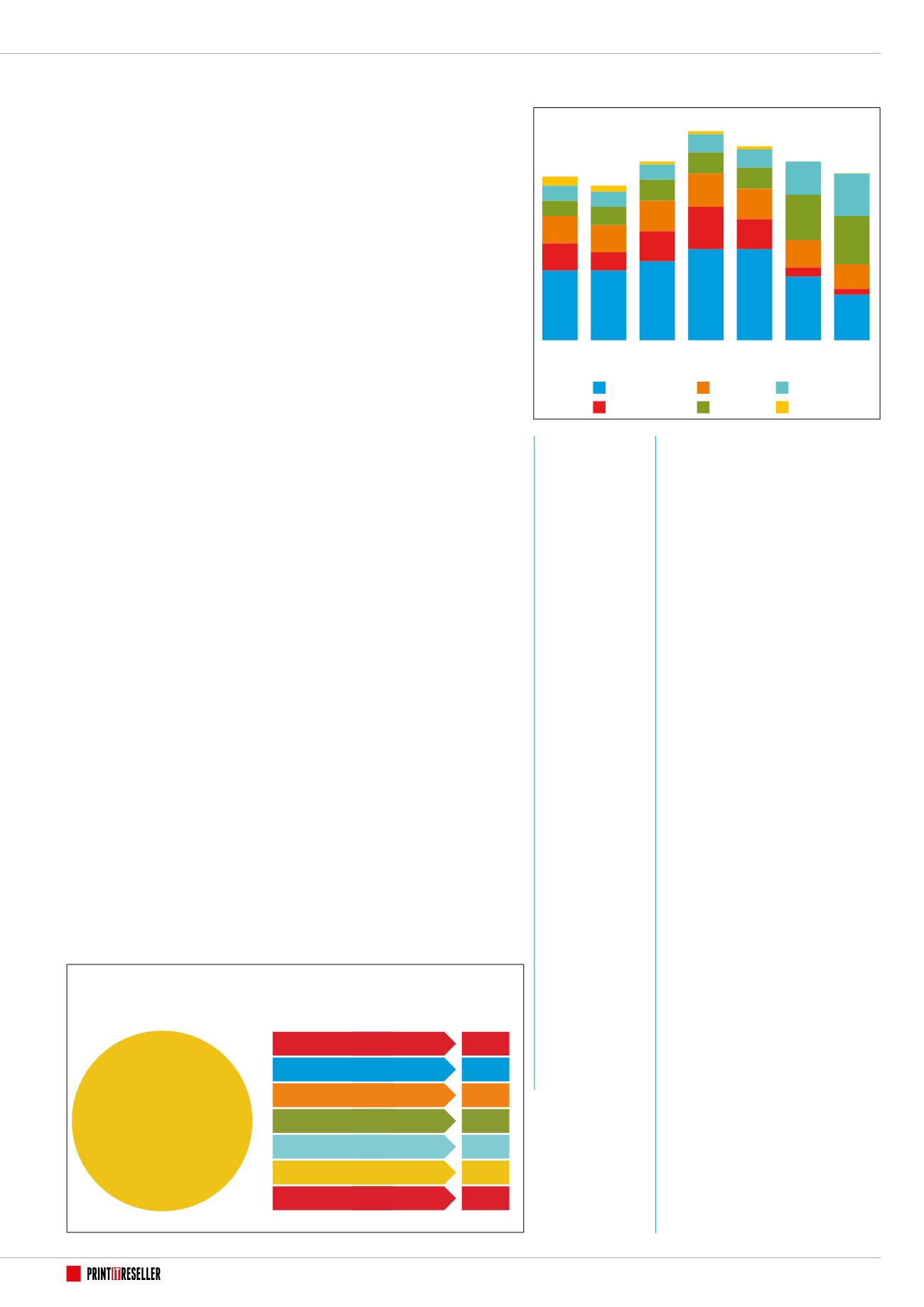

Purchases from mail by life stage and channel

Overall, we can see that all life stage groups use multiple response channels, albeit

with certain biases.

Unsurprisingly, the older groups w re more likely to say they responded by post

or phone, but not exclusively so – almost as many respond online via a PC.

But the people most likely to use digital channels to respond were in the Young

Families group – not the younger ‘digital natives’.

There are two clear implications.

First, since response can come via a variety of channels, mailers need to ensure

that, regardless of channel or life stage target group, they make the journey to

respond as seamless as possible. However, mail sent to specific groups can be

improved by highlighting the channel(s) they are more likely to use.

The second is that the real response rate – and ultimately value – of any mail

campaign, has to be measured across a width of channels, not just one or two.

In the following sections we describe some of the charact ristics of each group and

offer some tips that may help guide better targeted and more effective executions.

Online via tablet/

smartphone

9%

10%

10%

10%

3%

3%

7%

7%

7%

6%

7%

6%

5%

5%

5%

10%

10%

11%

9%

9%

9%

8%

16%

5%

6%

14%

14%

14%

15%

23%

21%

23% 26%

30% 30%

Online via PC

Shop

Phone

Post

SMS

Older

Retirees

Empty

Nesters

Older

Families

Young

Families

Couples

Sharers

Fledglings

The full

Life Stages

of Mail

report,

including tips on how

to market to specific

life stage groups, can

be downloaded from