01732 759725

DRUPA PREVIEW

44

in-line finishing, delivering folded, collated

and glued blocks ready for a simple

cover application and final trim. This is

particularly true for monochrome books.

Publishers and book printers have

now gone beyond just comparing print

costs and are considering the total

cost of manufacturing. The flexibility

of inkjet allows book production to be

re-engineered and book publishers to

reduce their stocks and their publishing

risk, bringing overall cost and service

advantages. Colour books are quickly

following the mono lead.

For other products, the benefits of

changing manufacturing processes to inkjet

are not so clear. Well-established analogue

methods are meticulously honed to

minimise cost while delivering high quality.

This will change as more companies install

inkjet equipment, learn its capabilities and

exploit new opportunities.

A growth opportunity

Inkjet technology already has many early

adopters who are profiting from the

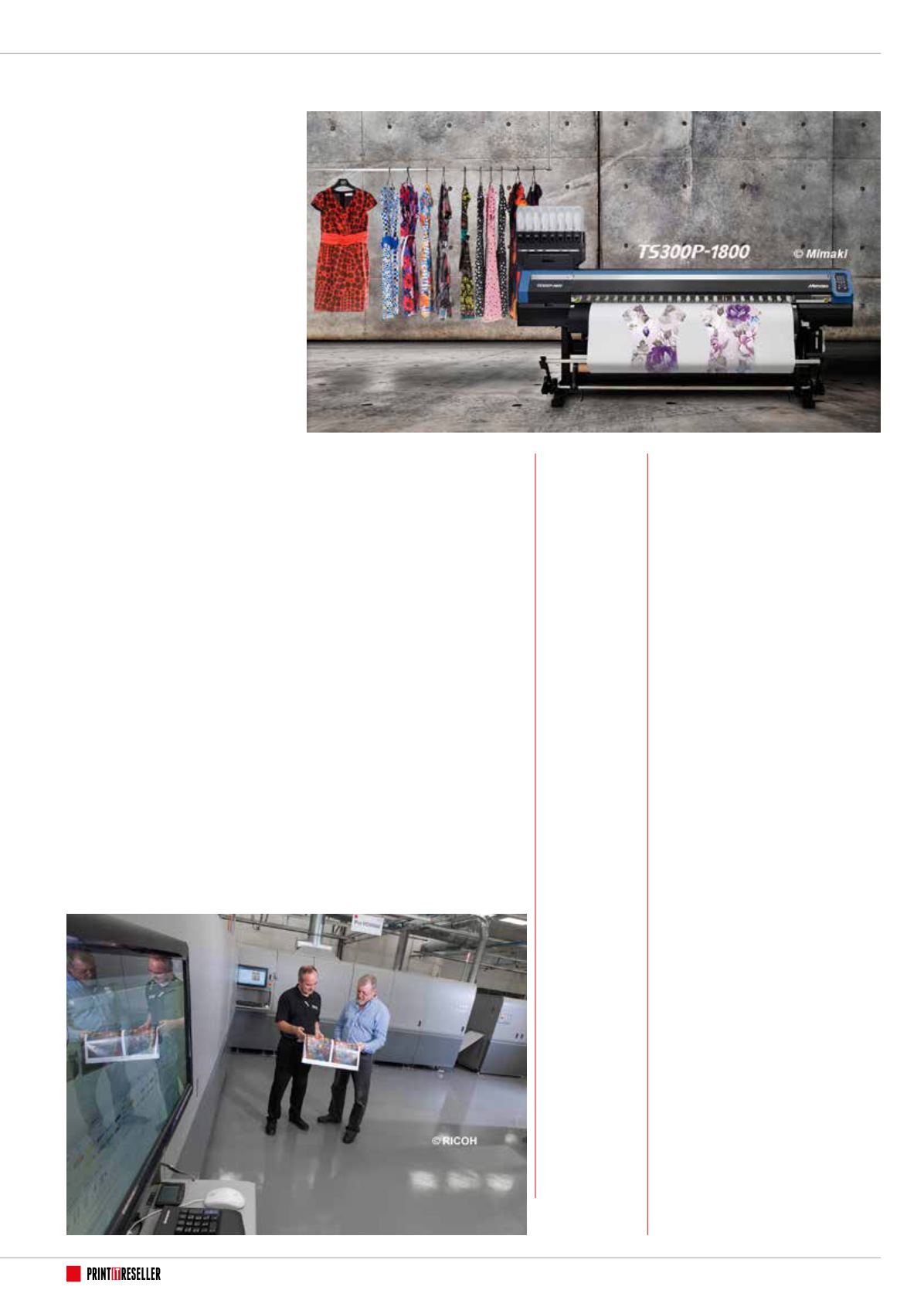

technology. For example, HansaPrint in

Finland, a

€

70m turnover firm specialising

in retail and publishing, recently installed a

high speed Ricoh Pro VC60000 press.

HansaPrint Business Unit Director Jukka

Saariluoma said: “Prior to experiencing the

Ricoh Pro VC60000, I did not believe that

there would be a major shift from offset

printing to inkjet. But the new press has

changed my mind. Our clients are very

excited by the new level in quality and the

increased flexibility offered and are moving

significant amounts of their work from

offset to inkjet.”

All key analyst organisations predict

very high growth for inkjet print volumes

and values. Smithers Pira expects the value

of inkjet printing output for graphics and

packaging to more than treble between

2010 and 2020, from

€

23 billion to more

than

€

70 billion (in current values), with

a forecast CAGR of 12.7% from 2015 to

2020. HP reports that its customers alone

have produced more than 100 billion inkjet

pages since 2009 when it installed its first

production inkjet press.

Beyond traditional print

Inkjet printing applications include

coding & marking, addressing, security

numbering & coding, photo-printing,

wide-format (sheet, roll-fed and hybrid),

flatbed imprinting systems, narrow web,

tube & irregular shapes, high speed wide

web and sheetfed – to name a few.

Outside traditional printing and graphics

applications, inkjet has revolutionised

ceramic tile printing and it is growing very

strongly in textiles and other industrial

decoration applications, from pens and

memory sticks to architectural glass and

laminated decor.

Thus, inkjet offers opportunities for

expansion into areas that may not have

been considered by traditional print

providers. Paul Adriaensen, Agfa Graphics

PR Manager, said: “Not too long ago,

inkjet was praised as an alternative to

conventional systems for its ability to

offer single-off sheets, short runs and

personalised prints. But the technology

has also been introduced to new areas.

This creates interesting dynamics in the

industry.”

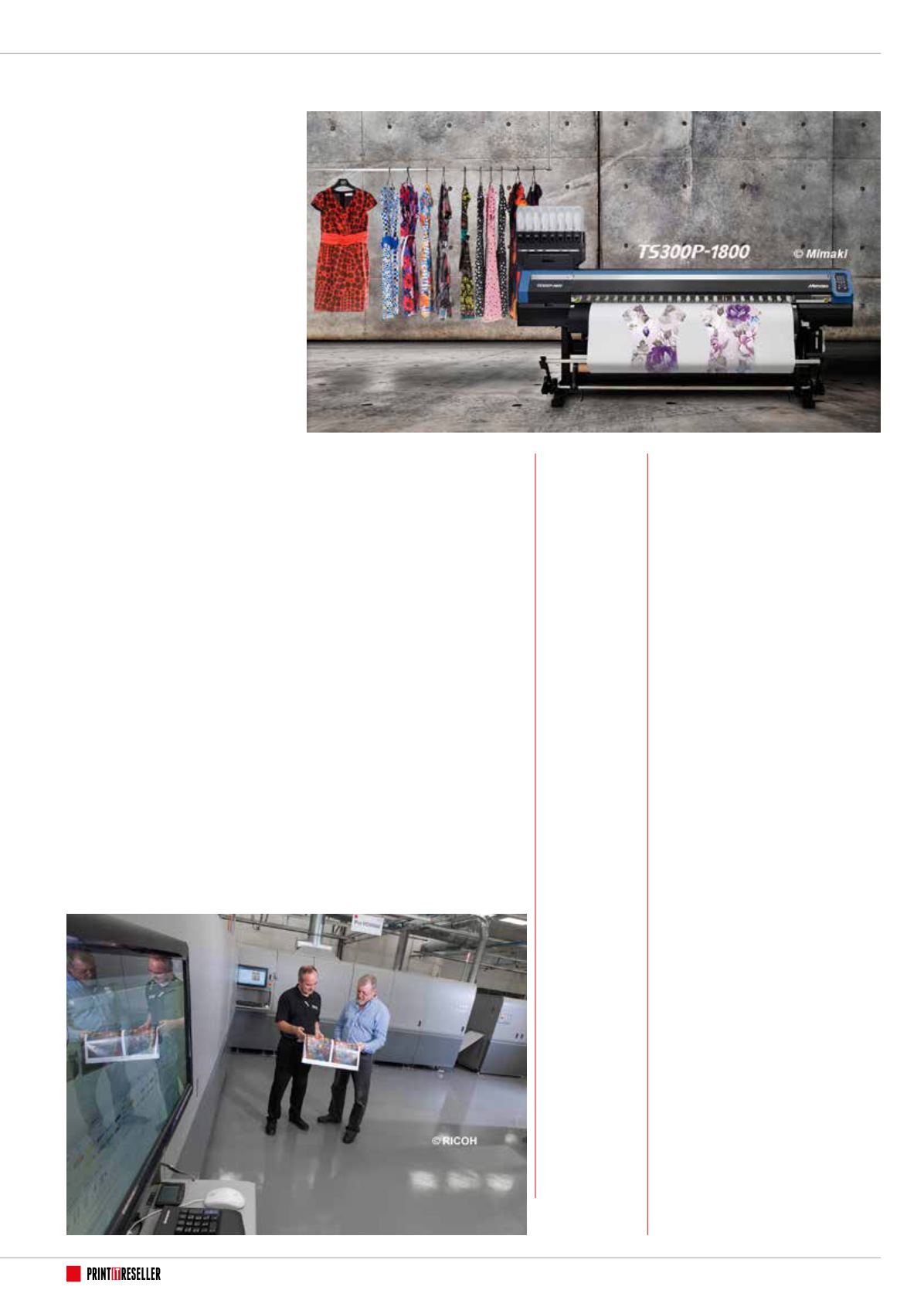

For example, Mimaki and other

manufacturers are introducing innovative

digital inkjet solutions with higher speeds

and productivity to meet the demands of

the booming textile market where inkjet

has a major advantage over other print

processes, as it is the only non-contact,

high quality, high performance process.

Better inks

Technical advances are primarily in new

and better control of print heads, better

inks and a much wider selection of readily

available and more affordable inkjet-

treated papers.

Ink manufacturers spend a great deal

of money on developing new inks that

perform well in the heads and provide

excellent print quality. This has produced

ink with higher density levels offering

offset-like quality at lower coverage.

There are also now more substrates that

perform well with inkjet, aided by colour

management improvements.

There are many routes to market for

inkjet inks. Some equipment manufacturers

formulate and manufacture their inks;

others sell ink that is made under license

by ink specialists. In low-end wide-format

inkjet, there are independent third-party

ink suppliers competing with the OEM.

This is probably the healthiest part of

the market for end users, with thousands

of machines sold each year consuming

millions of litres of ink.

This is not the case with high

performance systems, where the equipment

supplier typically provides ink tailored for

Technical

advances

are primarily

in new and

better control

of print

heads, better

inks and a

much wider

selection

of readily

available

and more

affordable

inkjet-treated

papers.

...continued

A Mimaki

TS300P-1800

textile printer

The Ricoh Pro

VC60000 inkjet press