01732 759725

INTERVIEW

44

...continued

Lexmark by Apex Technology and

Samsung’s printer business by HP, some

have wondered whether Sharp’s printer

business will be next?

Sykes is quick to allay such concerns,

explaining that Sharp gives Foxconn a new

and important route to market.

"Sharp gives Foxconn added market

potential. With Foxconn's support, we

want Document Solutions to sell more;

both companies share the same ambitions

for Sharp to grow aggressively in the next

three to five years. That’s very exciting,”

he said.

“One of the concepts we can now

look at is ‘the smart office’, what we call

‘connected technologies’. We want to

be the one-stop customers go to when

they want to kit out an office or school.

Sharp could do the network cabling and

infrastructure; the IT equipment – servers

and laptops; the MFPs and displays;

the furniture of the future, which will

have technology built in; and even the

telephony. Because Foxconn is helping us

put that wider portfolio in place, all the

pieces will integrate and talk to each other.

That idea of the smart office is something

we want to pursue.”

Sykes adds that, short-term, Sharp is

already benefiting from the relationship.

“Foxconn has invested a lot of money in

some new A4 products, which has always

been one of the weaker parts of Sharp’s

offering. That’s underway now and we will

see new products coming to us within the

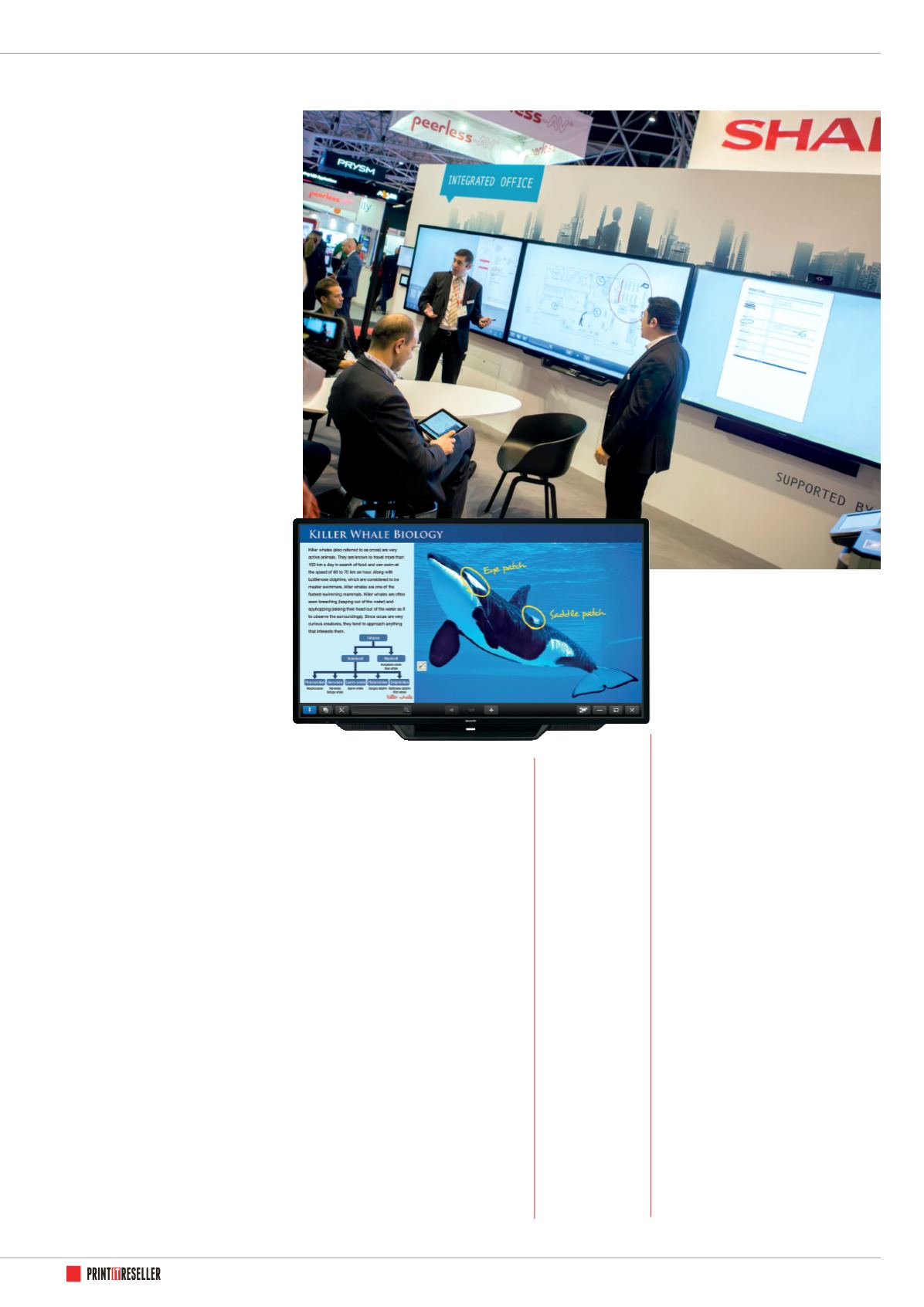

next 12 months. We also have a new Visual

Solutions range that we will be launching

at ISE next February. This will broaden

our reach with different functionalities,

different price points and some products

that are slightly different to anything else

on the market. That’s a real benefit – being

able to fill the gaps in our offering.”

4

Listening to our dealers

The final strand in Sharp’s growth strategy

is to listen closely to dealers to see what

Sharp can do to help them prosper, exploit

emerging opportunities and find new

annuity streams.

To this end, Sharp is setting up half a

dozen steering groups addressing specific

technologies and market areas, including

SMEs, enterprise, visual solutions, EPOS, IT

services and education.

“Steering groups will be made up of

key stakeholders from all areas of our

business – direct teams, indirect teams,

product marketing teams etc.. We are

saying ‘come and join us – let’s look at all

this potential, at the marketplace and you

tell us how we can help you’. We want

dealers to be involved in these steering

teams, so we can decide what’s most

important and how we can get there in

two, three or five years,” Sykes explained.

One of the main tasks of the steering

groups will be to establish how integrated

Sharp solutions can be packaged and

delivered to channel partners in a way that

makes it easy for sales people to sell and

implement them within Sharp’s broader

connected technologies concept.

Choppy waters

In the meantime, Sharp, like all

manufacturers, must deal with the

day-to-day challenges presented by an

increasingly uncertain economic and

political outlook. In negotiating difficulties

like Brexit and the weak pound, Sykes

says he aims always to put the interests of

dealers first.

“The pound was in a really good

position 18 months ago. Since then,

there has been a drop of about 15-18%.

Because we buy everything from Europe,

our costs have gone up by 15-18%.

That can obviously do nothing but hurt.

We have talked to our dealers and on

November 1 put through price increases

In negotiating

difficulties like

Brexit and the

weak pound,

Sykes says he

aims always

to put the

interests of

dealers first

of about 5%. We take the long-term view

that we don’t want to damage our dealers

who might find it hard to pass price

increases on to the market. The idea is that

when the pound eventually improves we

still have a strong channel and dealers who

remain in a good position. We don’t want

to make knee-jerk decisions that damage

our dealers,” he said.

And, of course, where there is

disruption, there is also opportunity. By

strengthening its channel engagement,

Sharp is likely to be an increasingly

attractive option for dealers affected by

market consolidation.

“Some major dealers in the UK dual

source HP and Samsung. They do this

for lots of reasons, but mainly to have

a stronger product line and to play

manufacturers off against each other. The

fact that those two product lines have

come together as one business could make

dealers look for another supplier so that

they are not beholden to one manufacturer

and have more options and choices. We

think this is an opportunity for us to talk to

dealers and get them to consider Sharp,”

explained Sykes.

Even in Sharp’s darkest hours, Sharp’s

global Document Solutions Business was

one of the company’s bright spots. Now,

with the backing of Foxconn and freed

from the financial constraints of recent

years, it has the opportunity to live up to

its potential.