01732 759725

36

STORAGE

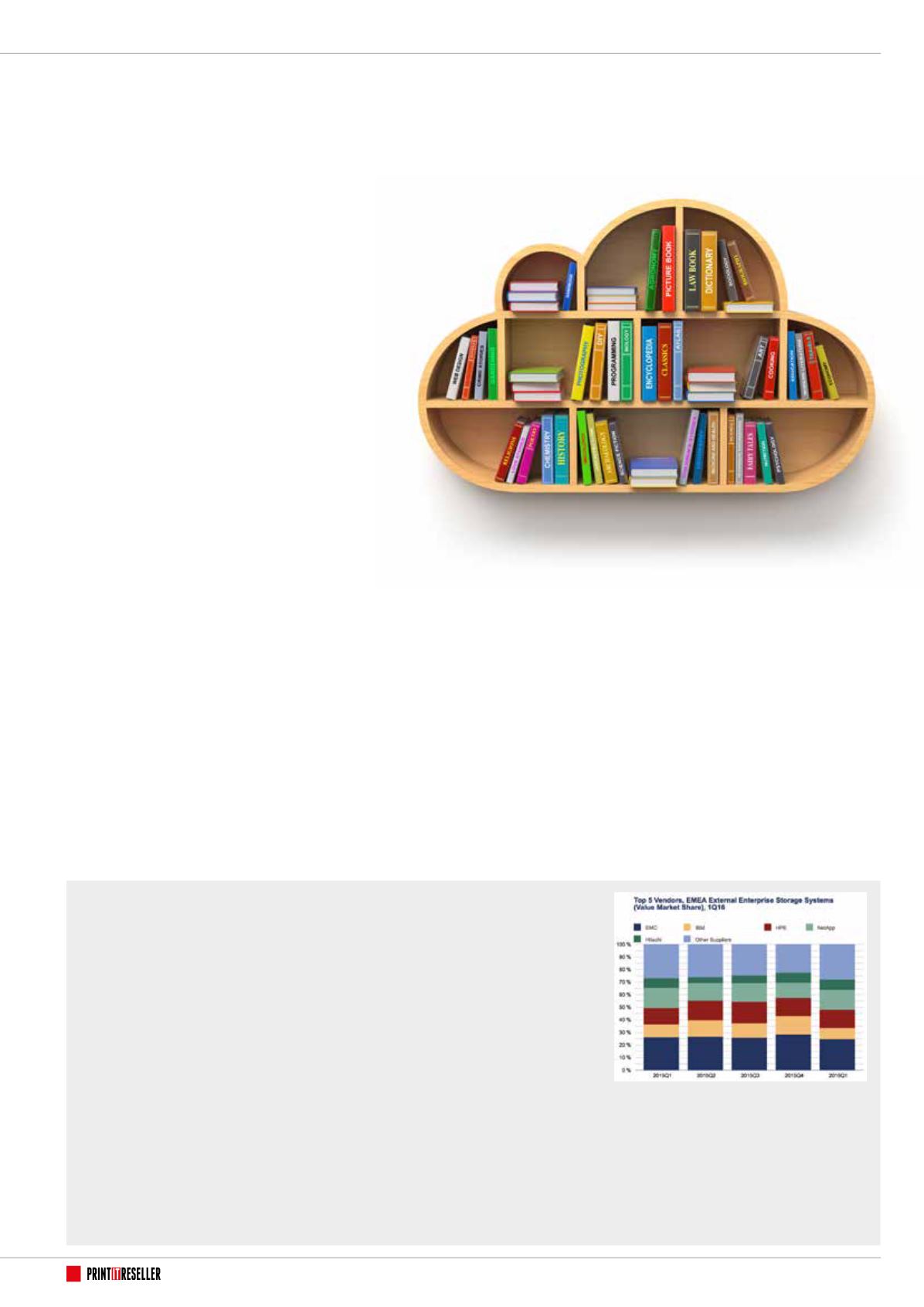

Flash is the only bright spot for

EMEA external storage, according

to IDC

The traditional hard disk array (HDD)

segment in EMEA declined for yet another

quarter, falling 23 per cent in user value,

according to the latest EMEA Quarterly

Enterprise Storage Systems Tracker

published by IDC.

The flash market, on the other hand, recorded

another bumper quarter, with all-flash systems

growing 96 per cent annually and hybrid flash

arrays growing at a more modest four per cent

year on year. Bucking the overall trend of a

decline in capacity shipped, flash arrays recorded

triple-digit growth in capacity this quarter,

accounting for nearly 60 per cent of total

shipments.

"Flash is the only vivid note in yet another

lacklustre quarter characterised by unstable

emerging markets and a negative seasonality

effect," said Silvia Cosso, Senior Research

Analyst, European Storage Research, IDC.

Total EMEA external storage systems revenue

fell 4.9 per cent year over year in the first quarter

of 2016, the capacity shipped in the quarter also

dropped 3.5 per cent, trends that according to

IDC indicate a move away from external storage

to internal storage in the region.

“External storage continued to decline in

2016 in Western Europe as traditional storage

arrays struggle to attract investment," said

Archana Venkatraman, Senior Analyst, European

Storage Research, IDC. "The double-digit drop

in capacity in 1Q16 demonstrates how mature

Western European organisations are moving

to newer, more intuitive storage technologies

such as internal or server-based storage to meet

their capacity requirements. In the next few

quarters we expect to see continued growth in

flash storage and a push to internal storage as

organisations take an integrated approach to

their infrastructure to take it closer to application

needs."

The latest WW Quarterly Cloud

Infrastructure Tracker published

by IDC shows that EMEA public

and private cloud IT infrastructure

spending (server, disk storage and

Ethernet switch) has grown 17.6 per

cent in the first quarter of 2016.

The tracker is designed to provide a

better understanding of what portion

of the server, enterprise storage systems

and networking hardware markets are

being deployed in cloud environments.

Importantly, IDC points to the fact that the

tracker does not include an assessment of

the impact of the UK leaving the EU.

"Our forecast for the UK may be

adjusted downward in the following

quarter as IDC expects a 'challenging

transition' if the UK activates the process

of EU withdrawal," said Kamil Gregor,

Research Analyst, European Infrastructure

Group at IDC.

The cloud-related share of total EMEA

infrastructure expenditure grew to more

than 25.1 per cent in 1Q16, an increase

of four per cent on last year. In terms of

storage capacity, IDC reports that cloud

represented almost thirty per cent of total

EMEA capacity in the same period, with a

6.1 per cent decline over the first quarter

in 2015.

"IDC expects this

market to reach a

value of $10.7

billion by 2020,

or 46.4 per cent

of total market

expenditure,

making it one of

the strongest growth

areas for the European

infrastructure sector, compared

with the expectation of a stagnant, if not

declining, traditional market," Gregor said.

Public v private cloud

Within the cloud segment, all regions are

expected to increase spending in 2016

with investments in public cloud growing

at a faster rate than investments in private

cloud IT infrastructure. IDC says spending

on private cloud IT infrastructure will

grow by 10.3 per cent year on year with

more than 60 per cent of this amount

contributed by on-premises private cloud

environments, while spending on public

cloud IT infrastructure will increase by 18.8

per cent in 2016.

For cloud environments combined, the

analyst predicts that spending on Ethernet

switches will be growing at the highest

rate, 39.5 per cent, while spending on

Cloud is the strongest

growth area

IDC: Spending on IT infrastructure for cloud

environments will be strong in 2016

server and storage will grow at 11.4 per

cent and 14.2 per cent respectively.

For the long-term forecast, IDC expects

that spending on IT infrastructure for cloud

environments will grow at a 13.1 per cent

compound annual growth rate (CAGR) to

$59.5 billion in 2020. This will represent

almost half of the total spending on

enterprise IT infrastructure.

In Western Europe, the growth in

cloud infrastructure spending has been

distributed nearly equally between

enterprise storage and servers, with

year-on-year growth of 12 per cent and

16.6 per cent respectively. The two types

of technology currently account for about

42 per cent and 45 per cent of the total

market.

External storage market in decline