01732 759725

BULLETIN

14

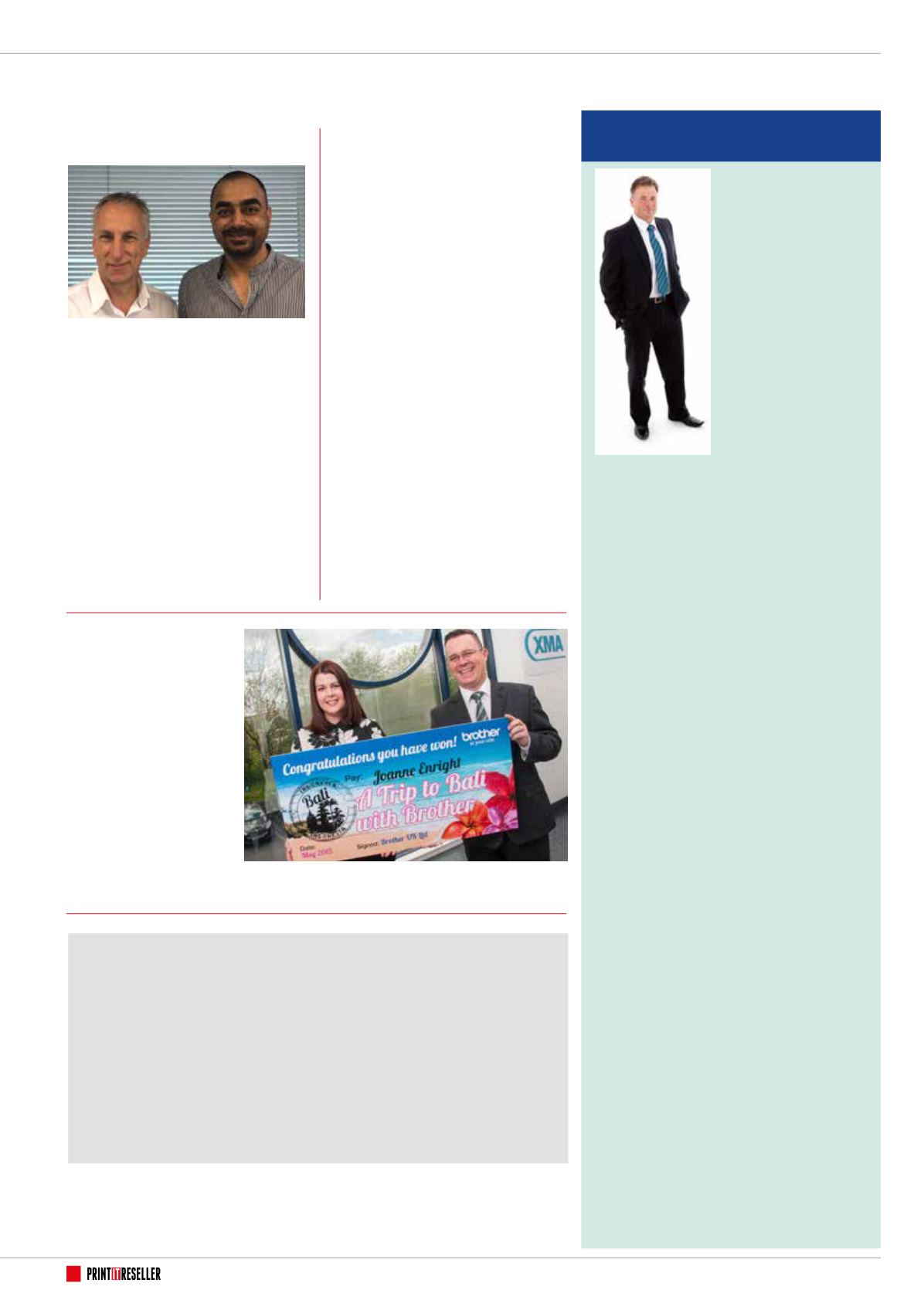

Shock win for

Joanne

“I nearly fell off my chair

when I found out I’d won!”

So says Joanne Enright,

public sector account

manager at XMA, who beat

more than 40 resellers to

win the top prize of a luxury

holiday to Bali in Brother

UK’s recent printer and

scanner promotion. Twenty

runner-up prizes included

iPad Airs, iPad minis and

£50 and £25 bonus bonds.

UTB moves into technology finance

United Trust Bank has appointed Ken Archbold to help launch a new technology

finance offering that enables companies to fund the purchase of hosted IT

services, as well as hardware, software and maintenance contracts.

Ken Archbold has more than 15 years experience in the technology arena, most recently

working on the Microsoft program for De Lage Landen, where he helped put together payment

options.

Archbold, who will work with Kevin Flowerday, United Trust Bank’s Head of Technology

Finance, said: “United Trust Bank has a fantastic pedigree in asset finance, bridging and

development finance and we intend to apply the same values and develop the same reputation

in the Technology funding marketplace.”

Free up cash locked in

software

A new asset finance product designed to

free cash locked up in software has been

launched by the technology division of

Lombard Asset Finance.

The Software Licence Solution (SLS) from

Lombard Technology Services (LTS) is aimed at

businesses that develop their own software (or

outsource development to a third party) and

own the corresponding rights.

Keith Nowland, Regional Sales Director at

LTS, said: “This innovative asset finance product

presents a real opportunity for firms to release

cash that can be used in different areas, such

as research and development or purchasing

other assets. The intellectual property is sold

to us and we then licence use of the software

back to the business for an agreed term, which

is usually three to five years.”

Businesses retain day-to-day commercial

use and ongoing development of the software.

At the end of the agreed term, they can

continue using the intellectual property via

an ongoing fee at a nominal rate, or they can

introduce a third party to buy the intellectual

property.

Added purpose

Purpose Software, the High Wycombe-

based supplier of service management

software, has expanded its software

development team with two new

appointments – Graham Waterhouse,

who has more than 20 years’ software

development experience, and Muhammad

Waseem Iqbal, who has been a software

engineer for more than four years.

Mike Burke, Managing Director of Purpose

Software, said: “We have expanded our

software team and will be creating an exciting

and visionary roadmap of new products and

enhancements that enable customers to

improve control and efficiency across their

business operations.”

Banks are changing fast

by Andy Milsom,

Head of Partner

Training and

Development,

BNP Paribas

Leasing Solutions

Since the financial crisis

of 2008, debt finance

has been difficult

to obtain for many

small and medium-

sized businesses. In

this context we need

to remind ourselves

that the banks have

traditionally been, by some way, the largest

source of such finance. The changes forced

upon banks after 2008 have therefore had

a profound effect on the whole world of

business finance.

We must start by recognising that banks are

changing fast. Firstly, they are facing ever tougher

regulation from our own Financial Conduct Authority

and international regulatory bodies; and secondly

they are facing competition from a growing number

of ‘fintechs’ who are finding it relatively easy to take

away the profitable transaction-based services from

which the banks have always generated significant

profit at little risk (e.g. foreign exchange).

Fintechs are technology-driven organisations that

deliver financial services ‘online’ and include the ‘peer

to peer’ lenders who provide a platform for those who

have money to supply those who need money, without

the involvement of the traditional bank intermediary.

Global investment in fintech businesses has grown

dramatically in the last two years, from $4 billion in

2013 to $12 billion in 2014, and will almost certainly

continue on a very steep growth curve. This has the

potential to leave only the relatively expensive and

riskier parts of banks’ business free from competition.

SMEs will find it increasingly difficult to obtain

new or extend existing bank credit lines because the

due diligence now needed for a bank to extend a

£10,000 business loan takes nearly as much time as

one for £1,000,000. Under these circumstances, it

is easy to see how banks might lose interest in the

smaller transaction and smaller customer.

Further, recommendations have been put forward

that might require banks to set aside additional

capital reserves when lending to SMEs. If this

proceeds, it will add further costs to such transactions.

On a more positive note, as the banks continue

to withdraw from a market that has traditionally

provided significant levels of finance for SMEs to

acquire business equipment, the specialist funders in

the market will grow in importance. For those resellers

who understand the financial climate in which

they operate and can move towards offering their

customers a managed service solution, the future can

be approached with real confidence.

Competition winner Joanne Enright with Steve Gray, Brother UK

business manager for major strategic accounts.