01732 759725

46

VOX POP

Matt Goodall:

“I am sure that more

companies will sell out to the nationals,

but what happens is that the customer

sees a change from the local service that

they used to get to a national call centre,

and all that comes with that.

“We have seen how many of these

large companies acquire smaller companies

and as they progress, their reputation

become sullied and their service wains. The

end result is that the short term gain may

be beneficial, but the customers that don’t

get the service they need with look for

another local supplier as soon as they can

get out of their contract.”

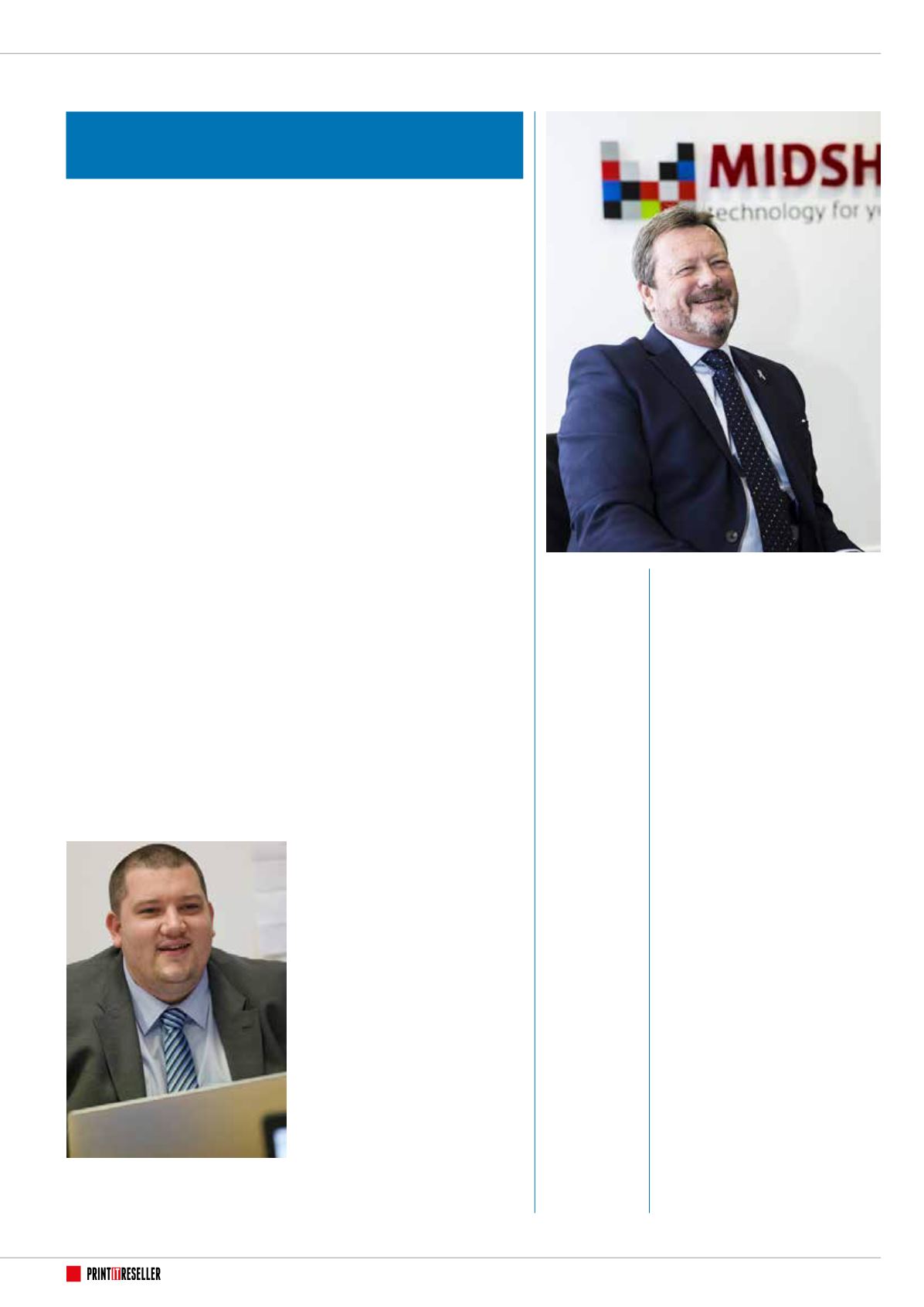

Scott Walker:

“You will unfortunately

always get the odd one or two customers

who will automatically associate a past

bad experience from a provider. However,

the message mustn’t be that ‘it’s business

as usual’. Why should it be? Why would

you want it to be?

“The message must be explained to

customers that there is in fact change,

positive change…and that they support

their provider during this period of

transition. Small or big, no MPS provider

gets it right 100 per cent of the time…it’s

how you put it right that counts.

“I’ve had mixed messages across the

board from contacts. Some aren’t happy

about recent acquisitions, some are

indifferent, and others are embracing the

change to see what it brings. Change can

often be a positive thing…they just need

reassurances.”

Mark Smyth:

“I have experienced a

large number of acquisitions of varying

sizes over many years and you always

experience some movement of clients

and employees. Clients typically do not

welcome change and the integration of

businesses drives change which leads to a

potential impact on the client experience

with account management, administration,

billing process and service delivery. The

outcome can result in the client voting with

their feet and they go elsewhere.

“With employees it’s somewhat

different, it’s about matching locations of

services such as call centres, field engineers

and account managers, where there are

strong potential areas of consolidation

and efficiency. The location of services

both organisations provide does not often

match or suit the acquiring business plans

and or footprint of offices, and therefore

employees are subject to reorganisation.

Compensation pay plans are also a

contentious issue as they vary between

organisations and employees are forced to

either accept changes or move on!

“Business efficiency is a key and vital

component to acquisitions that comes

from integration and consolidation and

that’s what makes acquisitions a viable

formula for growth! I believe there is now

some market recognition that managing

an effective transition and integration of

organisations can soften the blow for clients

specifically and therefore minimise the client

impact, whilst improving retention rates

through the integration process.”

Andy Perkins:

“Consolidation gives the

remaining local dealers more opportunities

to utilise their ‘fleetness of foot’ in

structuring their offering to individual

users.

“So much of our industry is now

software orientated with both local and

national resellers making significant

investment in their IT support teams. The

local reseller is capable of personalising

software implementation and ongoing

support.

“The use of remote diagnostics is

becoming increasingly important, but

there is a danger that this will reduce

the personal touch that customers value

and the locally based dealers are better

positioned to maintain relationships with

their client base.”

Sam Elphick:

“I wouldn’t say there has

been much of a noticeable change in

recent months to the industry, despite the

consolidations which have taken place.

I believe as a ‘local’ print provider we will

still strive to offer the best service and

value to our clients and to keep up to date

with changing technologies and to ensure

our product portfolio is strong. It is difficult

to say if the situation may change should

more acquisitions take place – I guess it

will be a case of ‘watching this space’.”

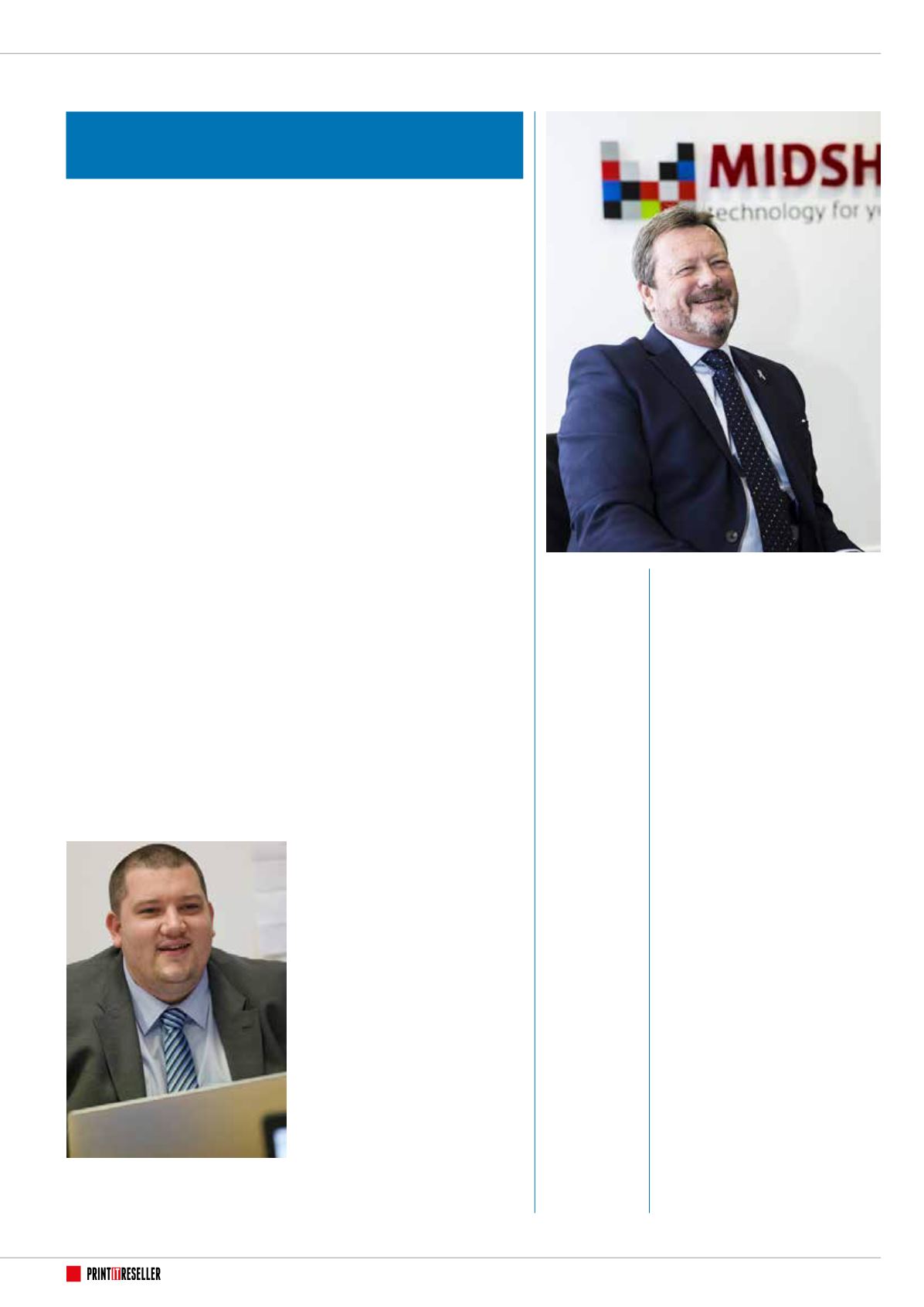

Kevin Tunley:

“Given the number of

recent acquisitions by manufacturers,

it’s inevitable that there will be more to

follow. Manufacturers have seen that their

equipment sales have been increasingly

reliant on their dealer network and are

taking action to secure their route to

market, by creating or increasing their

direct sales capability.

“We are moving back to the majority

of sales being direct from the manufacturer

or via the new breed of super dealers,

which will inevitably result in a reduction in

choice for the end user. However, for all the

reasons mentioned earlier, there will still

be a market for the remaining local dealers

who can develop closer relationships with

their clients and add value to the sale.”

The use

of remote

diagnostics

is becoming

increasingly

important,

but there

is a danger

that this

will reduce

the personal

touch that

customers

value

...continued

PITR:

We’ve seen lots of consolidation in the industry. How do you think

the status quo has changed and will change as more acquisitions are

completed?

Scott Walker

Head of MPS Business Development

ZenOffice

Kevin Tunley

Sales Director

Midshire